Table Of Content

The larger your down payment, the less you’ll need to borrow and pay in interest. The larger your down payment, the less you’ll need to borrow and pay back in interest. Read our article to find out what questions you should ask when it comes to choosing the right lender for your needs. Based on the information you have provided, you are eligible to continue your home loan process online with Rocket Mortgage. The loan amount is the amount of money you plan to borrow from a lender.

Mortgage Prequalification Calculator – Forbes Advisor - Forbes

Mortgage Prequalification Calculator – Forbes Advisor.

Posted: Mon, 21 Aug 2023 07:00:00 GMT [source]

Best Mortgage Rates

If lenders determine you are mortgage-worthy, they will then price your loan. Your credit score largely determines the mortgage rate you’ll get. A fixed rate is when your interest rate remains the same for your entire loan term.

Costs Associated with Home Ownership and Mortgages

That monthly payment is likely to be the biggest part of your cost of living. Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. With house prices at already extortionate levels, now mortgage rates rising again, is there any hope for first-time buyers?

Mortgage Term

Suppose you are considering taking a $400,000 mortgage to buy a house. A lender offers you a $400,000 mortgage at a 2% fixed interest rate for 30 years, and you would like to calculate the monthly mortgage payments required for this loan. Conventional loans are backed by private lenders, like a bank, rather than the federal government and often have strict requirements around credit score and debt-to-income ratios. If you have excellent credit with a 20% down payment, a conventional loan may be a great option, as it usually offers lower interest rates without private mortgage insurance (PMI). You can still obtain a conventional loan with less than a 20% down payment, but PMI will be required. Loan term (years) - This is the length of the mortgage you're considering.

How to Lower Your Monthly Mortgage Payment

Home Insurance Calculator: Estimate Your Costs (2024 Rates) - Forbes

Home Insurance Calculator: Estimate Your Costs (2024 Rates).

Posted: Wed, 03 Jan 2024 08:00:00 GMT [source]

This includes the scrapping of Class 2 contributions, as well as a reduction of the rate of Class 4 contributions from 9% to 6% for the £12,570 to £50,270 earnings bracket. The change, announced by the chancellor in his March budget, impacts around 27 million payroll employees across the UK - starting this pay day. "You're spending time, energy and money doing something that doesn't have a lot of evidence behind it. We found it does make you feel good but you don't need to pay thousands to do it." When I asked the now-psychic where the £2,000 actually came from, he said it was payment for a modelling job he had been offered. To see the full breakdown, check out our mortgage payoff calculator. Homeowners association (HOA) fees are common when you buy a condominium or a home that’s part of a planned community.

What’s a homeowners insurance premium?

Down payment - The down payment is money you give to the home's seller. At least 20 percent down typically lets you avoid mortgage insurance. Most people use a mortgage calculator to estimate the payment on a new mortgage, but it can be used for other purposes, too. This formula can help you crunch the numbers to see how much house you can afford. Alternatively, you can use this mortgage calculator to help determine your budget. In addition, the calculator allows you to input extra payments (under the “Amortization” tab).

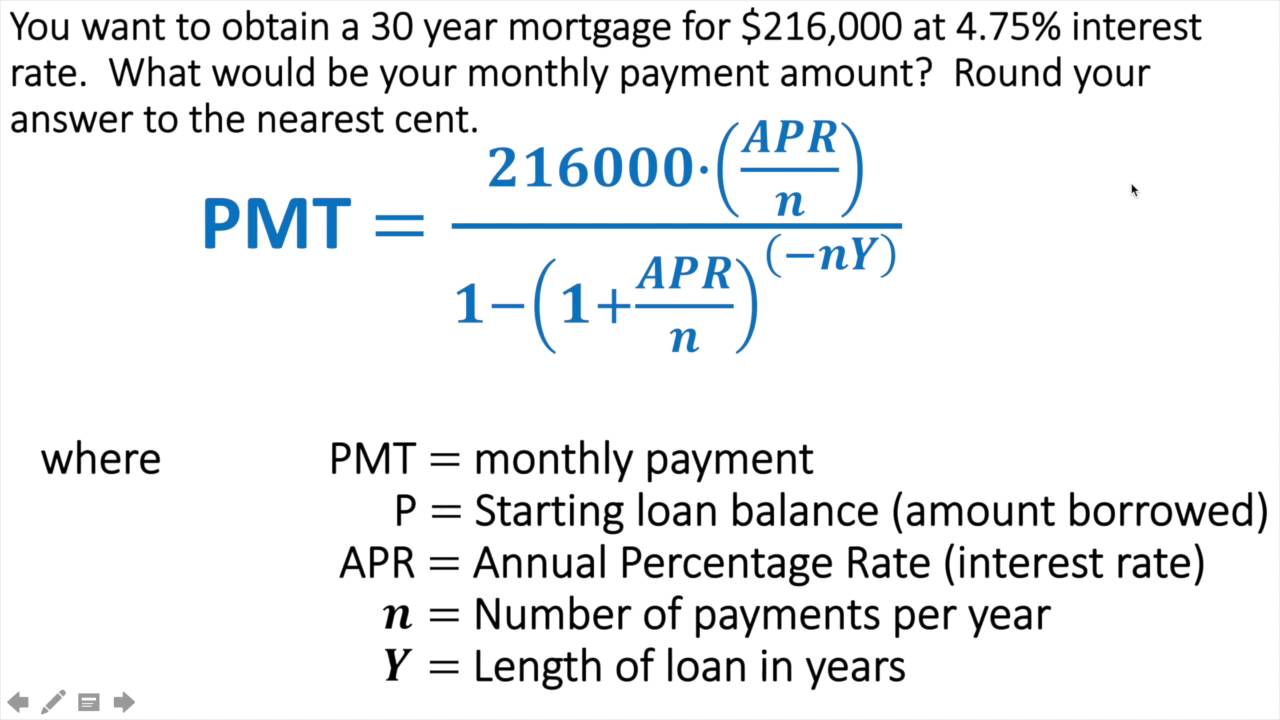

In this article, we’ll show you how to calculate your mortgage payment by breaking down the formula for you. We’ll also show you how the variables that go into the equation work, reviewing some ways in which you might save some money and feel better prepared for the future. Lastly, we’ll walk you through a few different calculators and their uses. Getting approved for a loan with Rocket Mortgage tells you exactly how much of a loan you can qualify for. Getting preapproved is quick and easy – you can even apply online from the comfort of your home. Use the mortgage calculator to see what your payments will be like with both options.

Fixed-rate mortgage calculator

Shorter terms, like a 15-year mortgage, have the opposite properties – larger payments, less interest paid. Getting the best interest rate that you can will significantly decrease the amount you pay each month, as well as the total amount of interest you pay over the life of the loan. Figuring out whether you can afford to buy a home requires a lot more than finding a home in a certain price range. Interest can add tens of thousands of dollars to the total cost you repay, and in the early years of your loan, the majority of your payment will be interest. That means using the above example, instead of making a $60,000 down payment, you’ll owe a $9,000 down payment.

A mortgage loan term is the maximum length of time you have to repay the loan. Longer terms usually have higher rates but lower monthly payments. It is possible to pay down your loan faster than the set term by making additional monthly payments toward your principal loan balance.

You would also pay off your loan in half the time, freeing up considerable resources. The answer depends on several factors including your interest rate, your down payment amount and how much of your income you’re comfortable putting toward your housing costs each month. Assuming an interest rate of 6.9% and a down payment under 20%, you’d need to earn a minimum of $150,000 a year to qualify for a $400,000 mortgage. That’s because most lenders’ minimum mortgage requirements don’t usually allow you to take on a mortgage payment that would amount to more than 28% of your monthly income. A HELOC does not increase your monthly mortgage payment as it involves a separate repayment structure. A home equity line of credit (HELOC) allows homeowners to borrow funds from a lender based on the amount of equity they own in the home.

SmartAsset’s mortgage payment calculator considers four factors - your home price, down payment, mortgage interest rate and loan type - to estimate how much you will pay each month. Here’s a breakdown with an explanation of each factor and how it influences your payment. When calculating your payment amount, you’ll want to look at the base rate and not the annual percentage rate (APR).

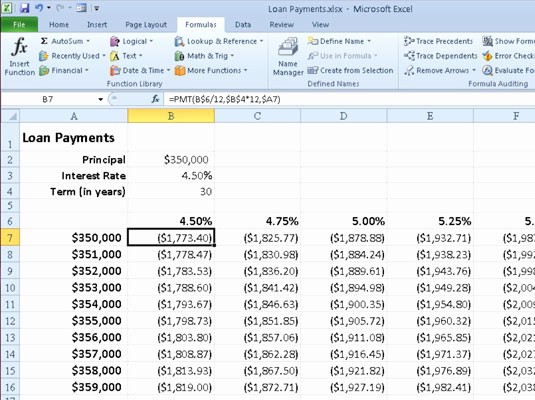

Average annual premiums usually cost less than 1% of the home price and protect your liability as the property owner and insure against hazards, loss, etc. Your loan program can affect your interest rate and total monthly payments. Choose from 30-year fixed, 15-year fixed, and 5-year ARM loan scenarios in the calculator to see examples of how different loan terms mean different monthly payments. Lenders look most favorably on debt-to-income ratios of 36% or less — or a maximum of $1,800 a month on an income of $5,000 a month before taxes. The Payment Calculator can determine the monthly payment amount or loan term for a fixed interest loan.

We believe everyone should be able to make financial decisions with confidence.

Or, you can use the interest rate a potential lender gave you when you went through the pre-approval process or spoke with a mortgage broker. Purchase price refers to the total amount you agree to pay to the property’s seller. This amount is typically different from your loan amount, since most lenders won’t loan you the full amount of a property’s purchase price. You can also see what the effect of a one-time, monthly or yearly additional payment would be on your number of monthly payments or interest. Crunching the numbers and wondering how mortgage rates are determined?

If you don’t have an idea of what you’d qualify for, you can always put an estimated rate by using the current rate trends found on our site or on your lender’s mortgage page. Remember, your actual mortgage rate is based on a number of factors, including your credit score and debt-to-income ratio. In addition to making your monthly payments, there are other financial considerations that you should keep in mind, particularly upfront costs and recommended income to safely afford your new home. These aren’t typically included in your monthly mortgage, even if you have an escrow account. However, it’s important to factor in these monthly and annual fees. The homeowners association (HOA) fees also impact what you can qualify for when you’re looking to purchase or refinance a home.